NEWS

US Crude Oil Prices Top $90 For The First Time This Year

Published

8 months agoon

More From Auto Overload

-

White Vehicle Seen Engulfed in Flames on Highway in Las…

-

Semi-Truck Nearly Hits Wyoming Highway Patrol Trooper On Snow-Covered Interstate

-

6 Popular Car Features That Will Never Be Seen Again

-

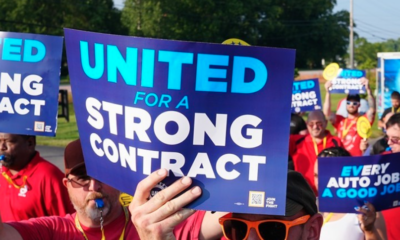

UAW Rejects Counteroffers From Automakers As Strike Deadline Nears

-

11 Essential Items You Need To Keep In Your Vehicle

-

Suspect rams truck into convenience store in order to rob…

-

Tesla S Owner Stranded on Christmas Eve Because Car won’t…

-

Škoda Sets World Records For Longest Continuous Drift On Ice

-

Seusspicious-Looking Passenger Causes Citation To Be Given To Driver

-

Massachusetts: Ambulance Narrowly Avoids Being Hit By Rolling Car From…

-

UAW Rejects Automaker Counteroffers As Strike Looms at Big 3

-

Freezing Roads Cause Traffic Accident on Highway Near Dallas, TX